Investors planning for intergenerational wealth transfer need to consider insurance as an asset class.

Quite simply, investors have two choices to ensure their estate planning goals are met. They can earmark a portion of assets and invest in vehicles that offer an appropriate level of risk and return. Or they can invest in a life insurance policy.

Life insurance offers several, almost “unfair” advantages over other investments. Foremost among these is the fact that the death benefit is largely tax-free. And if a policy is owned and funded by a personally-owned company, the proceeds of insurance can flow out of the corporation almost entirely tax-free to the heirs.

Life insurance also offers compelling internal rates of return (IRRs) when compared to other investments. Consider the following scenario:

- A married couple, each 60 years old.

- The husband receives a 50% underwriting rating and the wife is rated standard.

- Annual premiums of $100,000 secures $8 Million of coverage on a joint last to die basis.

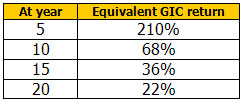

The table below shows what the equivalent GIC, pre-tax yield (based on a 46.41% personal tax rate) on the invested premiums would need to be in order to match the performance of the insurance benefit.

In fact, the last survivor would need to live to age 105 in order for their GICs to out perform the insurance contact.

Unlike other investments, insurance products are only available to investors that meet the underwriting qualifications. If intergenerational wealth transfer is a planning reality, then advocacy underwriting and competitive sourcing of the insurance contract can make the returns very hard to beat.

Here’s Simon Kay on BNN discussing insurance as an asset class: